Do you want to ensure your promotions resonate with your customers in your ad copies, titles, descriptions, and bullet points? It cannot be easy to know what will draw customers in. That’s why understanding “drivers and drainers” is key. Drivers are the factors that draw customers in. When you understand those key drivers, you can use them to your advantage in your promotional efforts. For example, if your product appeals to eco-conscious customers, emphasizing how it’s made with sustainable materials or great for the environment can be a great driver. On the other hand, drainers are the factors that can turn customers away. These are the elements you want to avoid in your marketing. If you’re trying to reach an eco-conscious audience, for example, promoting the product’s low price point might turn them off. By understanding the drivers and drainers in your target audience, you can create promotional materials that speak to them. This can be the difference between a successful campaign and one that falls flat. So take the time to research your customers and identify their drivers. Then, you’ll be well on crafting the perfect ad copy, titles, descriptions, bullets, consumer language, and ingredients.

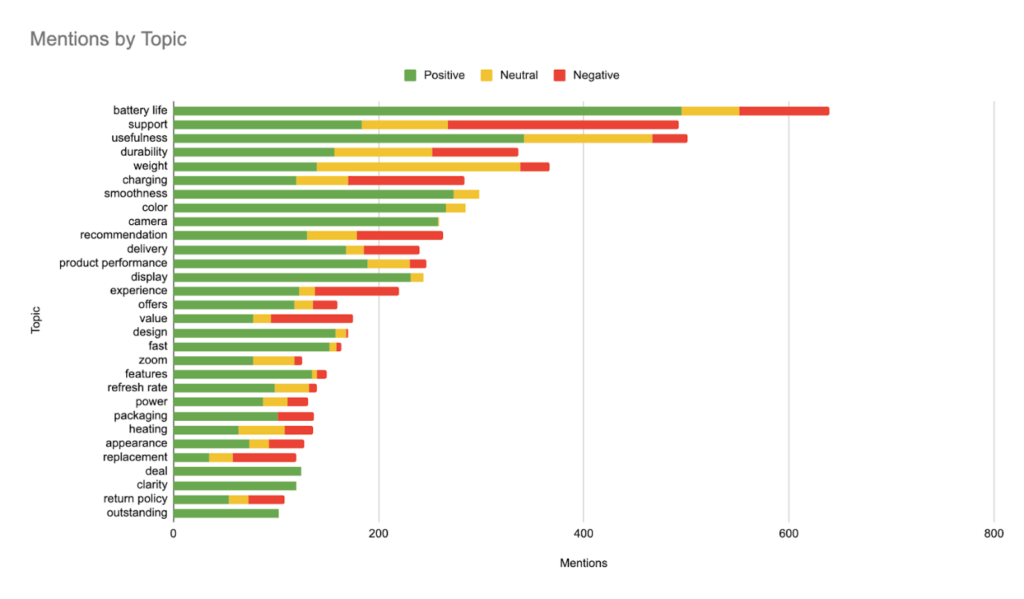

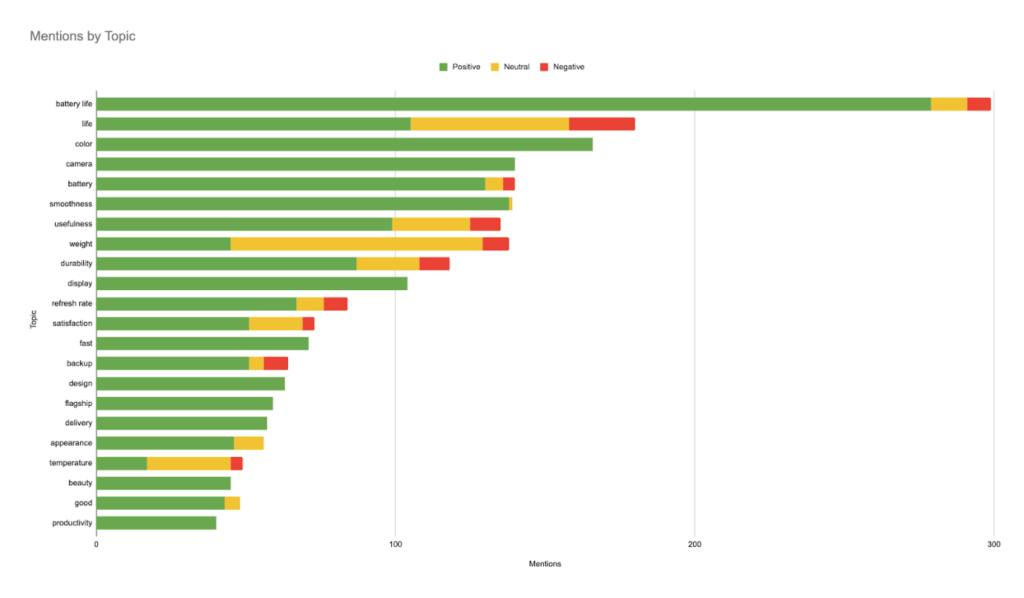

Let’s assume you are selling a smartphone on amazon and would like to emphasize your smartphone’s performance. Let’s see how this can be done. First, we collected reviews from amazon.in for smartphones in the price range above Rs.1,00,000. Then, we ran these reviews through our state-of-the-art machine learning models to extract topics and run sentiment analysis. We got all the reviews containing mentions of the topics related to “performance” – “performance”, “product performance”, etc. Then we ran these models through our topic extraction framework again to learn what customers are talking about when they are talking about performance. The following stacked bar chart shows the most frequently spoken topics with performance.

These topics can be used in any content like ad copies and descriptions where the performance of the smartphone needs to be emphasized. As we pick these up from customers’ voices, these words are more likely to strike the right chords in the customers’ minds.

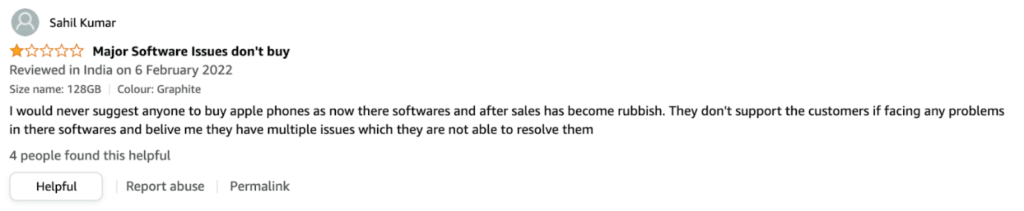

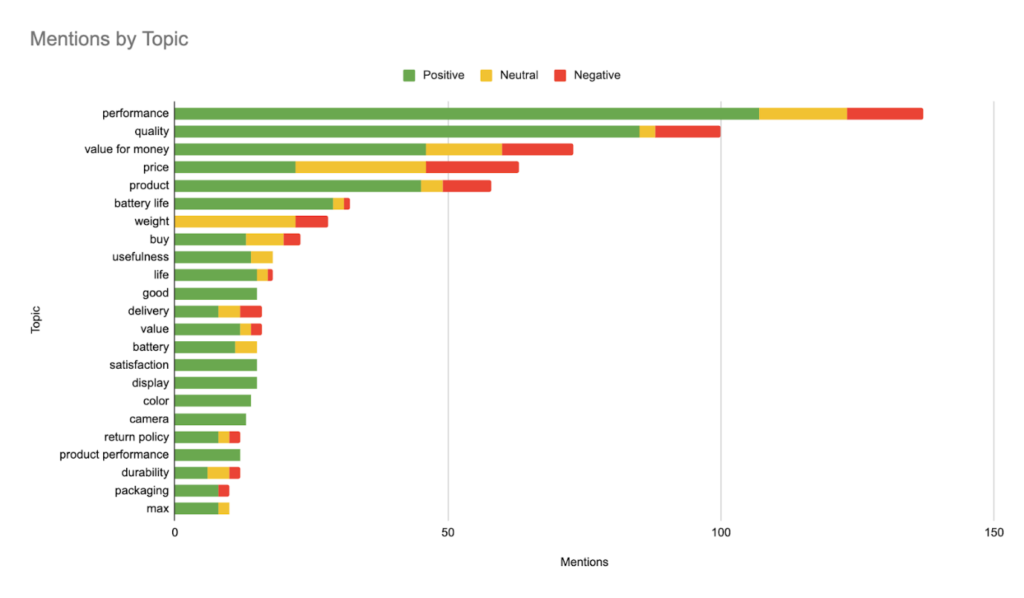

In another case, we looked at a specific smartphone listing – Apple iPhone 13 Pro Max (256GB) – Graphite. When we analyzed the reviews with our topic and sentiment lens, we found the following topic sentiment stacked bar chart

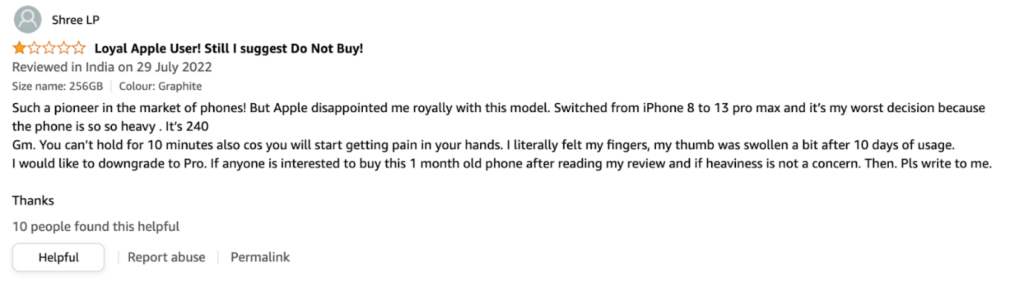

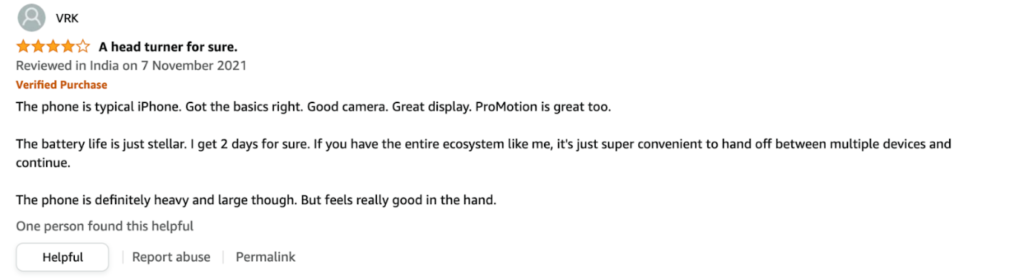

The above chart shows that the “weight” of the phone is primarily neutral and sometimes negatively perceived. There was no mention of the weight on the amazon product listing page. Looking at the reviews, it’s clear that people didn’t expect this and felt let down.

Handling the expectation of heavier weight via description or bullet points on the listing page can help avoid more such negative experiences for other customers.

These are simple examples. We can gain deeper insights by drilling into your topics and competitor topics to highlight your product’s advantages, etc. If this sounds interesting and helpful analysis for your products, please reach out to us by filling out the form below.