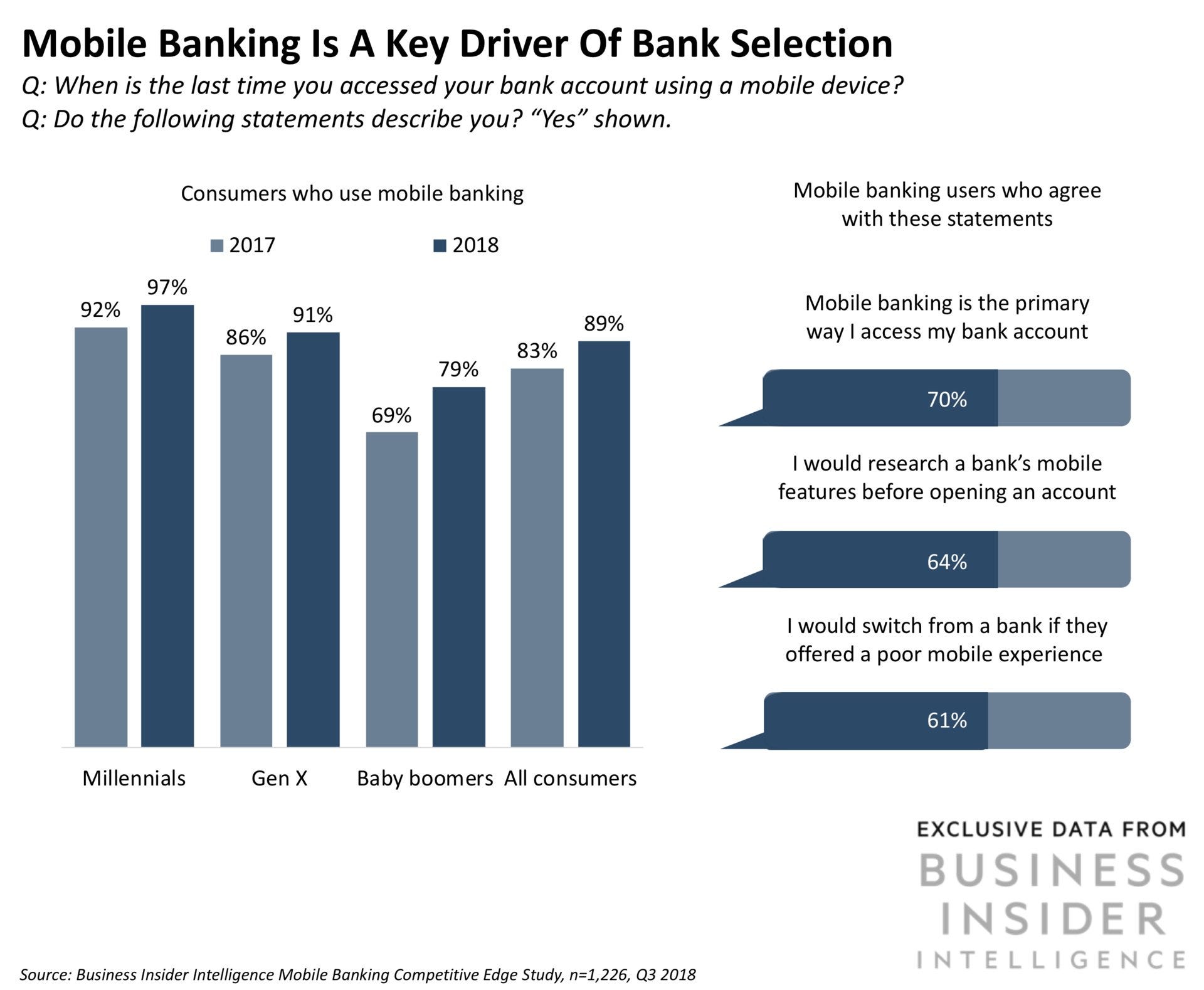

The Banking, Financial Services, and Insurance (BFSI) industry across the world has made significant efforts in navigating digital disruption and increasing mobility in the past decade. From being a cost center, digital banking channels have now evolved as revenue generators and cost savers by reducing the enormous operational costs of running brick and mortar branches. With the increase in smartphone and mobile internet penetration, technology has enabled customers to transact on the go. The convenience of swiftly making financial transactions anytime and anywhere with a few clicks has made mobile banking the most preferred banking channel among retail banking customers. Additionally, the power of mobile banking has paved the way for the digital-only challenger and neo banks, and the features offered on mobile banking apps have become key decision factors for customers selecting a bank.

Mobile Money – Market Overview

Mobile banking is already a pervasive trend. According to a recent study by Juniper Research, the total value of financial transactions via mobile devices would exceed $1 trillion by 2024 from $580 billion in 2019. It also predicts that nearly 3 billion people, roughly half the world population, would be transacting via mobile by 2021. This massive growth is fuelled predominantly by the increase in mobile and data penetration in the emerging markets, tech-savvy millennials, and digitally native Gen-Z.

Speeding up this growth of mobile banking is the recent COVID-19 situation. The lockdown measures have encouraged consumers to bank from home and have contributed to significant growth in mobile banking adoption globally. Recent research by PYMNTS has highlighted that 8.7% of customers are more likely to use mobile banking apps than they were before the pandemic outbreak.

Our Methodology

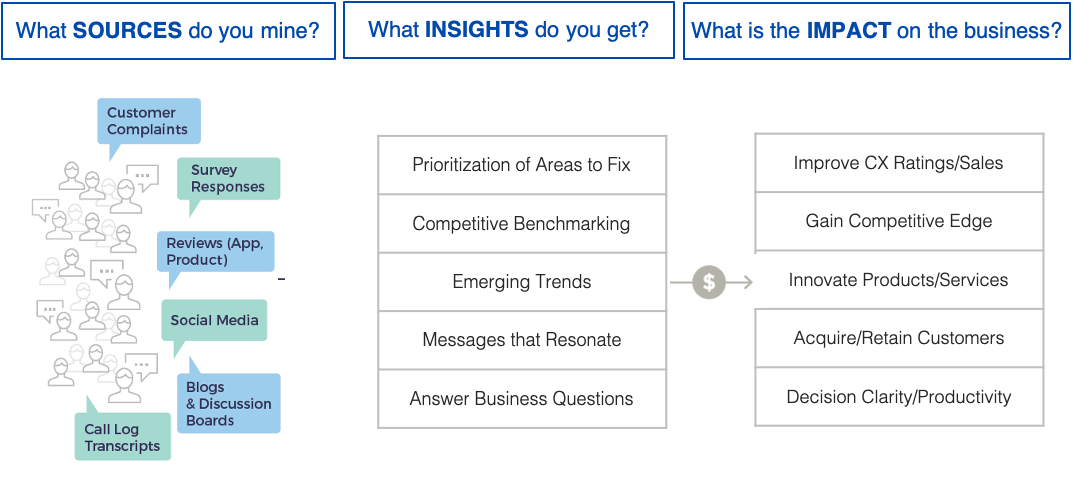

Financial Institutions hold petabytes of structured and unstructured data that can be leveraged to anticipate customer behaviors and create strategies. However, the regulatory bodies are becoming particularly strict about how the data gets managed and shared. These restrictions make it difficult for the efficient 3rd party analytics team to access the data to generate key decision-making insights, and they have to rely on publicly available data.

User reviews in open app distribution services such as Google Play Store and Apple App Store are critical in understanding the elements of customer experience. These app markets allow users to submit feedback for downloaded apps in the form of star ratings and text reviews. Mining and processing these text reviews will help in getting deep insights into elements of customer experience on the app.

In our VOCIS solution, thousands of reviews are mined based on the app category from the Play Store and App Store as the primary data source. Additionally, textual data from secondary sources such as blogs and review forums were also extracted for better insights. Further, the unstructured and textual review data is processed by Natural Language Processing (NLP) algorithms in performing multi-dimensional sentiment analysis to understand the user perception towards the app against a variety of critical factors. The insights from sentiment analysis guide the product team in optimizing the app.

Analysis Insights

The following are three key areas the insights derive via the Voice of Consumer Insights and Signals (VOCIS) module through aggregating thousands of customer reviews for the apps under the “Finance” category in Google Play Store and Apple App Store.

Brand Insights

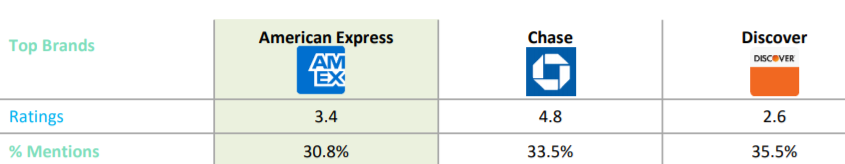

This analysis focuses on providing insights into the brand perception of the customers. With the use of sentiment analysis, it is possible to identify the most preferred brand and compare the perception of the brand with that of the leading competitors and use the same to create a data-driven brand strategy.

While Chase emerged as the most preferred banking app with a higher rating (4.8) and Share of Voice (33.5%). American Express can now drill down to assess areas for improvement and specifically target these areas as part of their overall strategy.

Product Level Insights

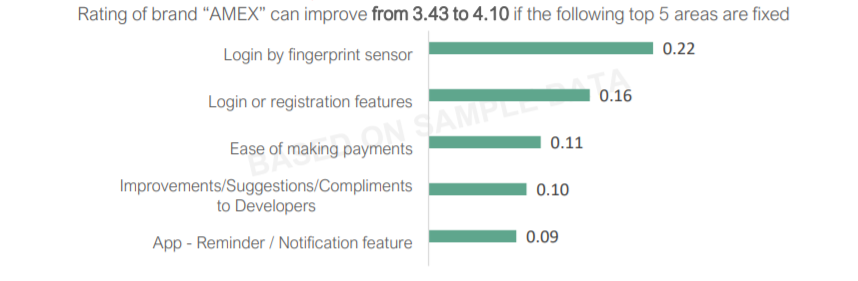

With sentiment analysis, it is possible to compare key product characteristics of similar apps to find features that resonate positively with the audience and the ones that identify areas for improvement. These feature insights guide banks in understanding the key gaps and how to modify the apps to appeal better to their customers.

Based on the reviews analyzed, it is evident that the features that Amex should focus on to improve the rating and customer experience are “ improvement in payments and notification”.

Competitor Insights

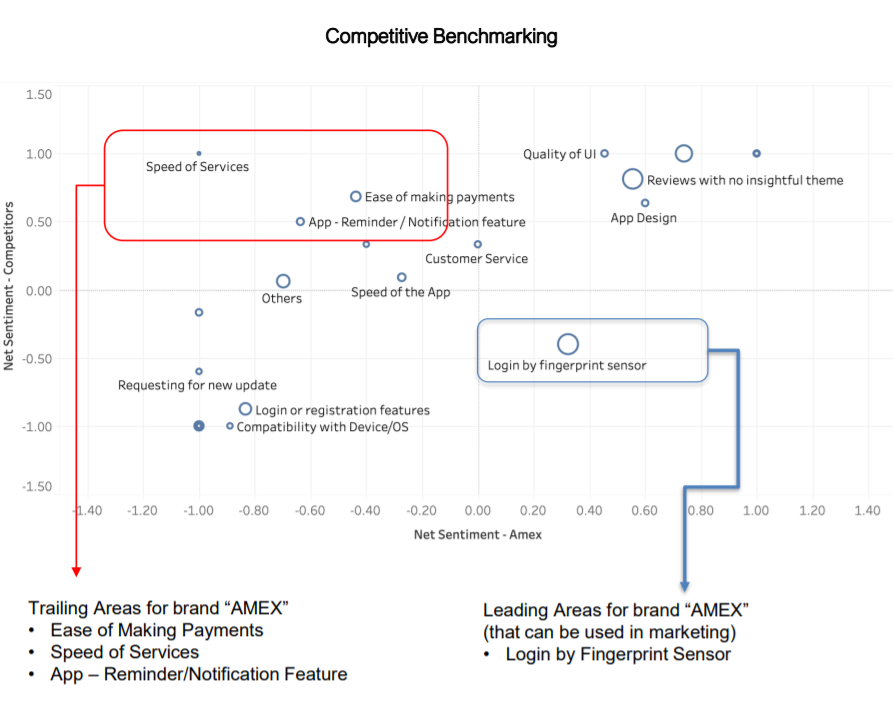

Competitor Benchmarking is quintessential as it helps in developing a deep understanding of the competitor apps and builds a picture of gaps to be addressed and opportunities to leverage. It also helps in streamlining and prioritizing the product development efforts by emulating your competitor’s winning app features.

While Amex is leading in the logon by fingerprint sensor theme with .22 vs. competition at -0.4, many people value this feature (ie. big bubble), and improving on this feature would significantly increase AMEX position overall.

SetuServ’s VOCIS platform augments consumer insights by extracting valuable insights from customer reviews in the app distribution platforms, such as Google Play Store and Apple App Store. VOCIS is highly capable of rapidly building custom models specific to use cases to generate highly accurate and relevant product insights for a better customer experience.