Obtaining insightful information about markets and competitors and transforming such data into valuable insights continues to be a challenge for most organizations today. Nevertheless, a majority of organizations rely solely on surveys, experience and intuition when making strategic decisions. As industries become increasingly complex and organizations are overwhelmed with data from a spectrum of digital channels, they must leverage both broad based data sources as well as Deep Dive Analysis to stay ahead of their competition. The deeper and more accurate the understanding of the market, customers, ecosystems, and competitors, the more the products and services shall be precisely designed to appeal to the target market and outweigh the competition.

Shortfalls Of Survey

Conventionally, businesses use surveys, most often with close-ended questions, as a primary research tool to acquire market intelligence. While surveys can efficiently target specific questions, attitudes and products to reveal details about specific areas, they fall short in uncovering the organic, emotional responses from consumers to a product or service. The following are the shortfalls in solely relying on surveys in acquiring competitive intelligence:

- Surveys depend on the consumer’s motivation, honesty, memory, and ability to respond, and they are very susceptible to bias.

- Respondents may not feel comfortable providing answers that unfavorably present themselves.

- Questions are pre-selected and may drive a respondent to provide opinion where they may have been once indifferent

- Inaccuracies in data due to discrepancies between the respondent’s stated opinions and their actual experiences and opinions.

- Structured surveys with closed-ended questions may have low validity when researching effective variables.

- Data aggregated from limited response shall not be generalized for the whole Target Audience group, as the number of respondents who choose to respond to a survey may be different from those who didn’t, thus creating bias.

Bridging The Gap With CRIS Deep Dive Analytics Module

With the continued growth in digital consumption and online competitive influence, businesses need to consider how to evolve to meet the changing demands of both the consumers and competition by moving beyond the limited scope of surveys. SetuServ’s Deep Dive Analysis module of Customer Review Insights and Signal (CRIS) provides a turn-key solution to uncovering organic consumer market research and competitive intelligence.

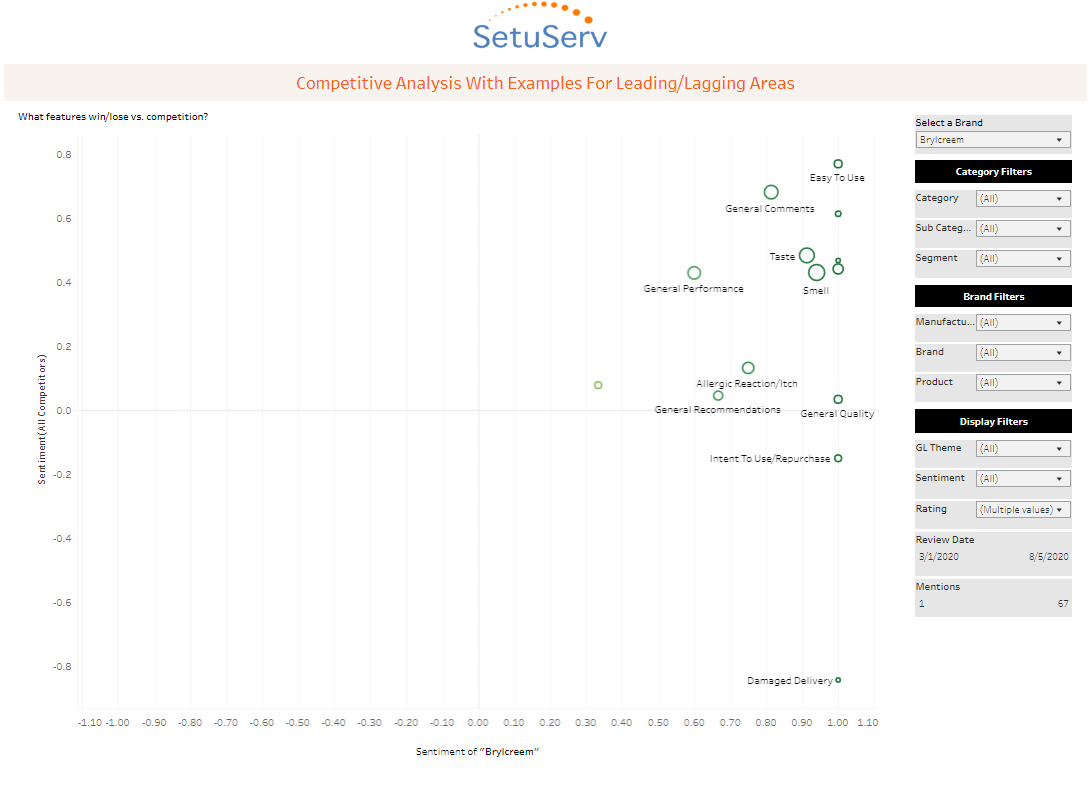

Deep Dive is a real-time analytics module (part of CRIS) that mines customer and competitor information from a variety of sources such as social media, review websites, and competitor websites and can also incorporate a company’s internal data sources such as e-mails and open ended survey results. Insights views showcase how a category, brand and/or product is trending, what themes are most impactful to performance and how these product feedback themes compare vs. competition Deep Dive employs a hybrid system of Machine Learning and Contextual Text Mining algorithms and augments the same with human curation in delivering competitive intelligence not just at the brand level, but drilled down to Category, Sub-Category, Product and Feature levels.

Listed below are some of the real-time insights that Deep Dive module is capable of delivering in a more granular level via an interactive and dynamic Tableau Dashboards.

Brand Performance

- Fundamental emotion that a customer associate with the brand and the competitors

- The sentiment of the brand against the competitors

- Bench-marking new products and innovation of brand and the competitors

- Attributes of the brand influencing purchase decisions

Segment Performance

- Top selling products in the segment compared to competitors in the same category

- Attributes influencing customers buying decision in the segment

- Opportunities for innovation in the product/service category

SKU/Product Performance

- Overall customer rating of the product against its competitors

- Market share analysis of competitors by product/service

- Customer sentiment attributed to product features

SetuServ delivers bespoke deep-dive insights into the consumer decision-making process based on the specific needs of the organization and helps brands gain an edge against competitors. Learn more about Deep Dive here.