Household cleaning products hold a key position in the Fast Moving Consumer Goods (FMCG) market due to their invaluable role in maintaining personal and public health. They are quite an essential product group as it helps in removing germs, soils, dust, and other contamination from hard or soft surfaces, thus reducing the presence of germs that cause infectious diseases and make the place more healthy and pleasant. The most common components in household cleaning products include alkalis, acids, detergents, abrasives, sanitizers, and spirit solvents. Also, some of the products contain hazardous ingredients such as flammable liquids, acids, and strong alkalis that require proper precautions while using. In this Voice Of Customer study, we shall discuss briefly the factors influencing customer decisions while buying household cleaning products.

Household Cleaning Products – Market Overview

Rapid urbanization, growing tendency towards maintaining personal as well as public hygiene are the key factors driving household cleaning products sales globally. According to recent research by Fortune Business Insights, the global household cleaning market size was $163.98 billion in 2019 and projected to reach $312.49 billion by 2027, with a CAGR of 4.97 % between 2020 to 2027. Also, it’s highly fragmented with key players such as Church & Dwight Co. Inc. (U.S.), Colgate-Palmolive Co. (U.S.), Godrej Consumer Products Ltd. (India), Henkel AG & Co. KGaA (Germany), Kao Group (Japan), The Procter & Gamble Co. (U.S.), Reckitt Benckiser Group Plc (U.K.), S. C. Johnson & Son Inc. (U.S.), Goodmaid Chemicals Corporation (Malaysia), and Unilever NV (U.K.).

The recent COVID-19 pandemic has created more consciousness on hygienic living and household cleaning among people across the world. This circumstance created a very high demand for household cleaning products that led to a global shortage that made manufacturers increase their production capacity and positively impacted global sales.

Our Methodology

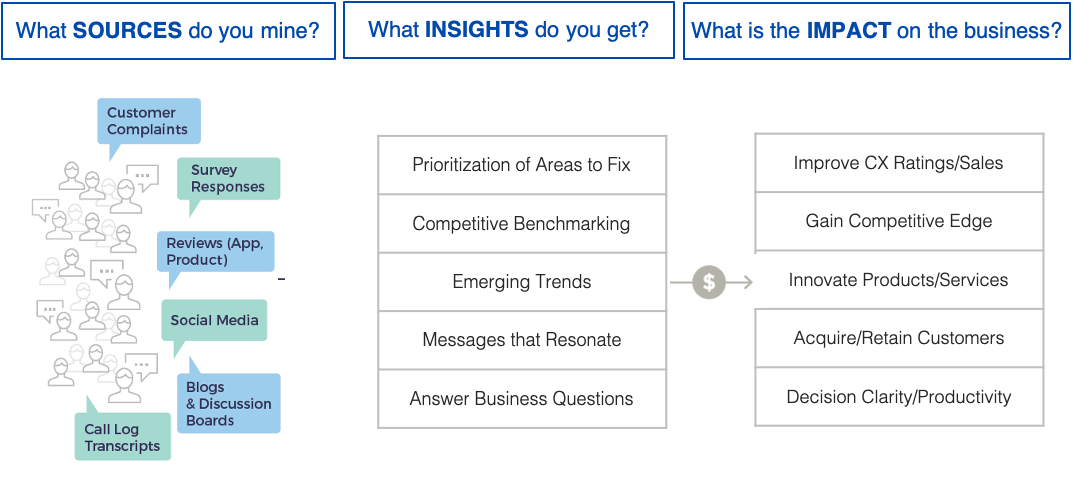

Traditional market research methods in the FMCG industry predominantly rely on manual surveys and store observations. These methods are inaccurate and highly prone to bias and human errors. To overcome this, we leveraged content generated by the customers online to ensure a large sample size that’s spread across geographies. We used web crawlers to text mine customer conversations from various online sources such as social media, discussion forums, e-commerce reviews, and blogs. Then the raw unstructured text data is further processed by Natural Language Processing (NLP) and Sentiment Analysis Engines, which uses AI models that are custom trained for the specific use cases with industry-specific taxonomies to generate insights. These valuable insights can be used by the companies to take strategic decisions and course corrections to stay ahead in the market.

Analysis Insights

The following are the insights automatically derived by the Voice of Consumer Insights and Signals (VOCIS) module by aggregating customer conversations from diverse sources such as social media, e-commerce reviews, discussion boards, and blog posts mined for FMCG related taxonomies.

Brand Insights

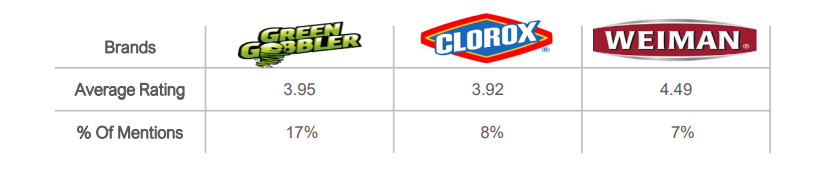

The value of a brand solely depends on the reputation of the brand, and it is achieved by consistently delivering value throughout the customer journey. This analysis focuses on providing insights into the brand perception of the customers throughout their journey. With the use of sentiment analysis, we shall compare the perception of a brand with that of the leading competitors and use the same to create a data-driven brand strategy.

Green Gobbler emerged as the most preferred brand in the analysis with a better rating and highest Share of Voice (SoV). These insights show the customer’s inclination towards natural and nature-identical cleaning products.

Product Level Insights

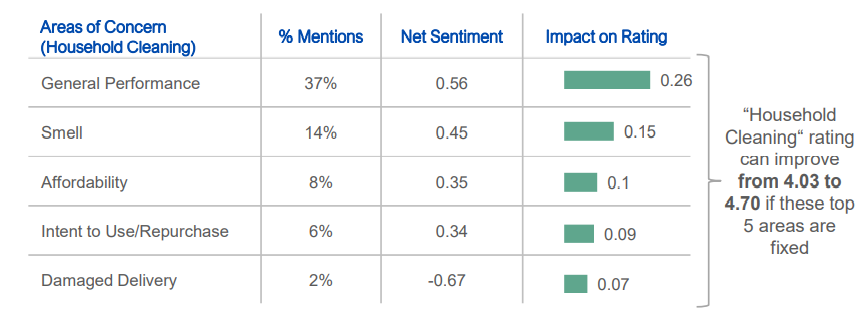

The buyer’s decision to purchase a product tends to be strongly influenced by a few key factors, features, and attributes. This analysis would help the brands in understanding these factors and optimize the product to appeal better to the target segment.

From more than 71K reviews mined from various online sources, the above were the top 5 features that got the potential to improve the rating, thus influence the customer’s buying decision positively. When it comes to Household Cleaning Products, the cleaning performance seems to be the decisive factor influencing customers, followed by the smell and affordability of the product.

Competitor Insights

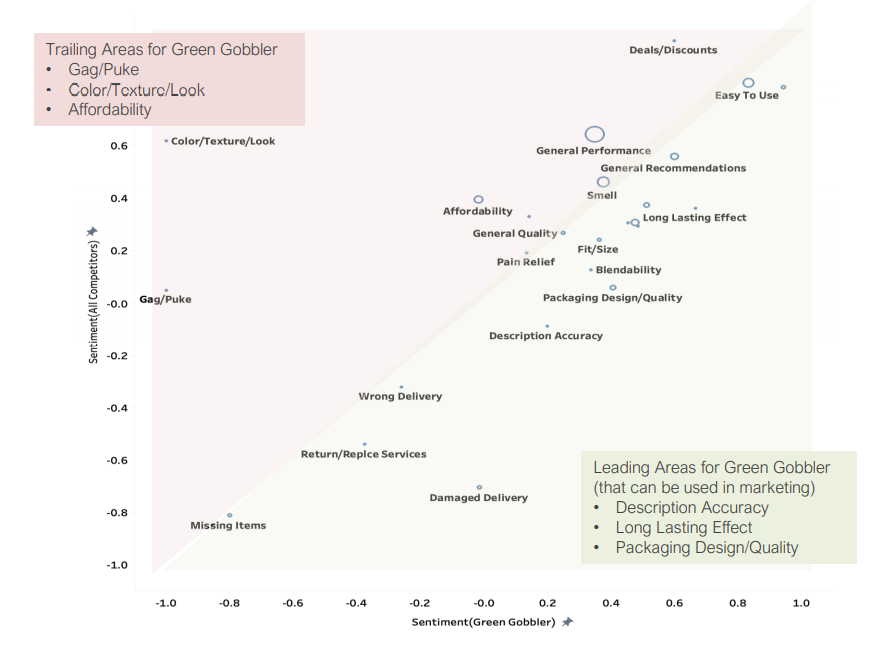

Competitor Benchmarking is quintessential as it helps in developing a deep understanding of the market ecosystem and builds a picture of gaps to be fixed and opportunities to leverage. It also helps in streamlining the product and marketing efforts by emulating your competitor’s success elements such as price and key product features.

The competitor benchmarking on product features for Green Gobbler, the top brand (based on the customer rating and SoV) against its competitors, highlighted the features that are favorable and the features that have scope for improvement. The attributes with a positive sentiment such as Package Design and Description Accuracy indicates the importance of packaging and optimal communication on the product package. Also, as the natural and nature-identical cleaners prized in premium, affordability emerged as a trailing factor.

SetuServ’s VOCIS platform can help FMCG companies in extracting valuable insights from customer reviews mined from various online sources. VOCIS is highly capable of rapidly building custom models specific to the use cases and generate highly accurate and relevant product insights for better business development and customer experience.